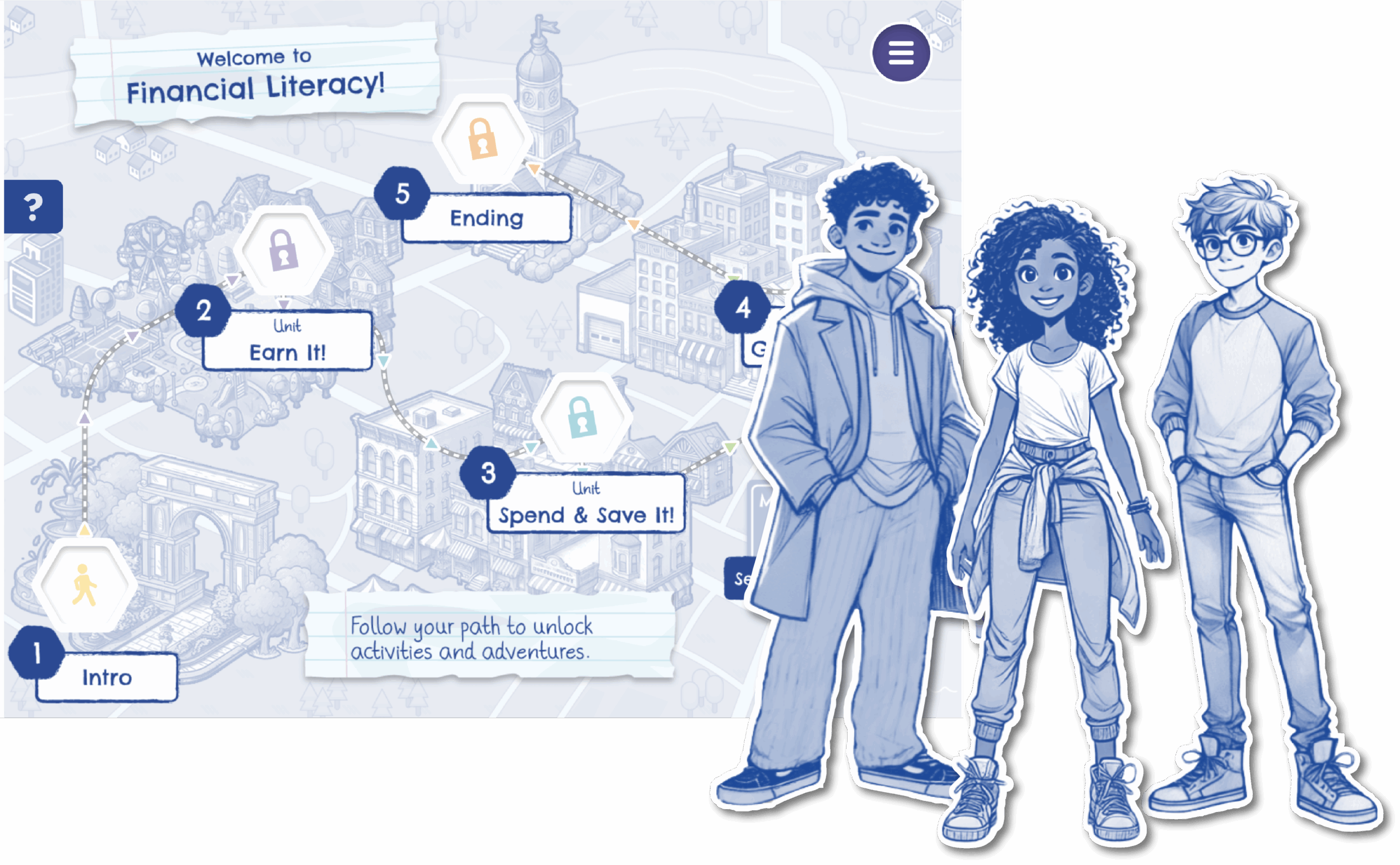

Footsteps2Brilliance Financial Literacy Career Readiness is more than a program—it’s a launchpad for students in grades 4–8 to build real-world skills through ELA, Math, and financial learning all in one.

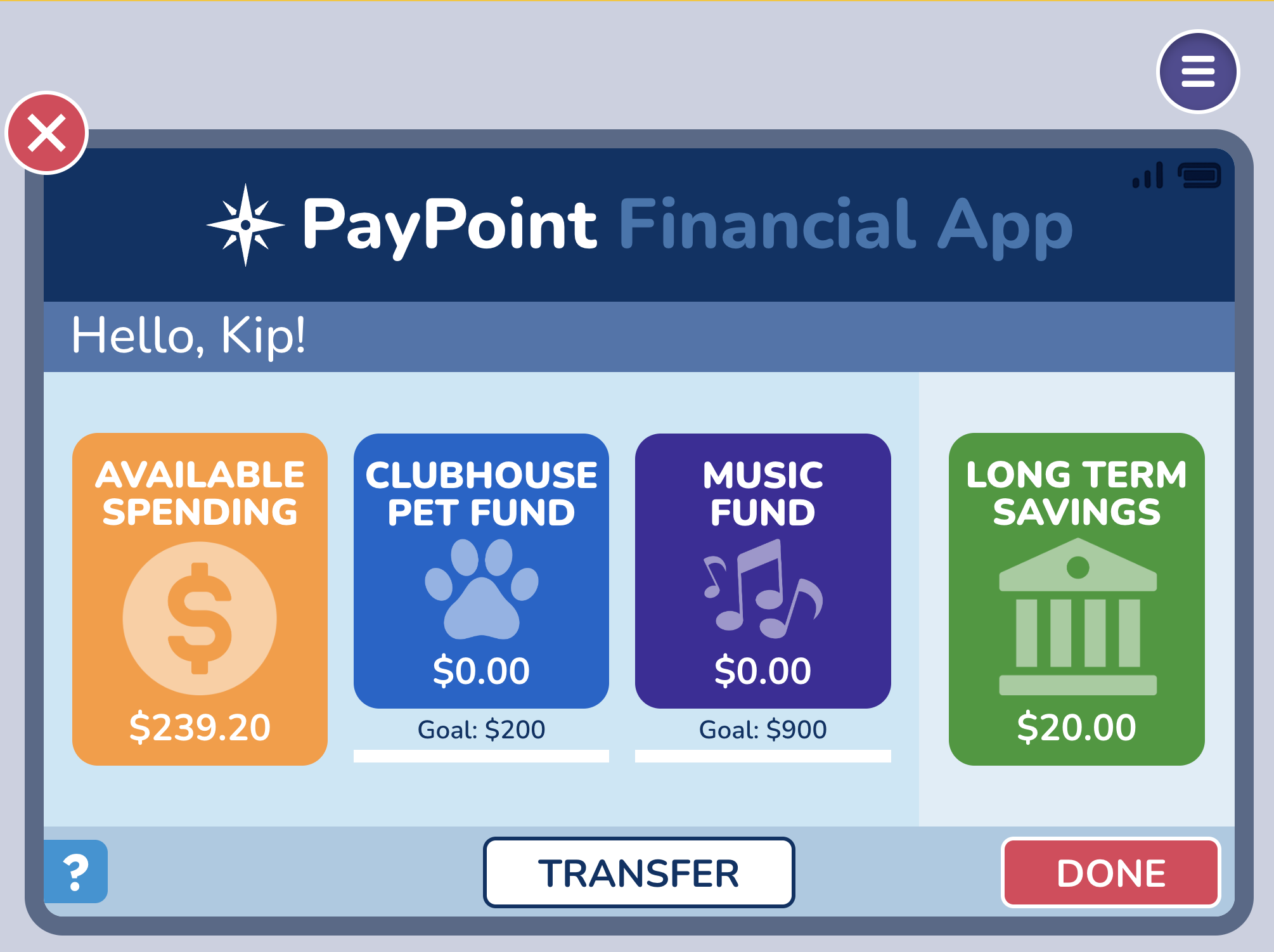

Students step into Prosper Point, a vibrant digital town that grows with them. As they level up, they read high-interest books, play standard-aligned games, and use an AI-powered Writing Coach to sharpen writing skills—without adding work for teachers.

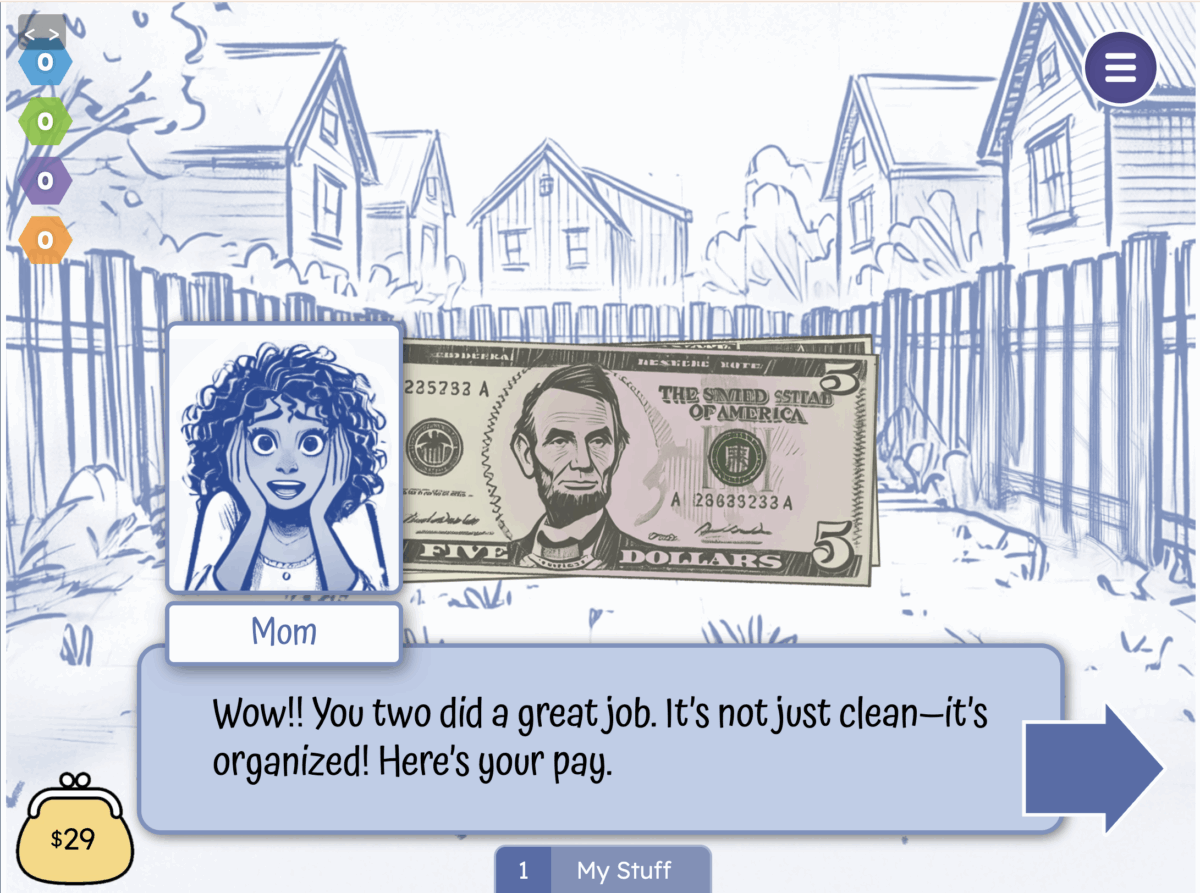

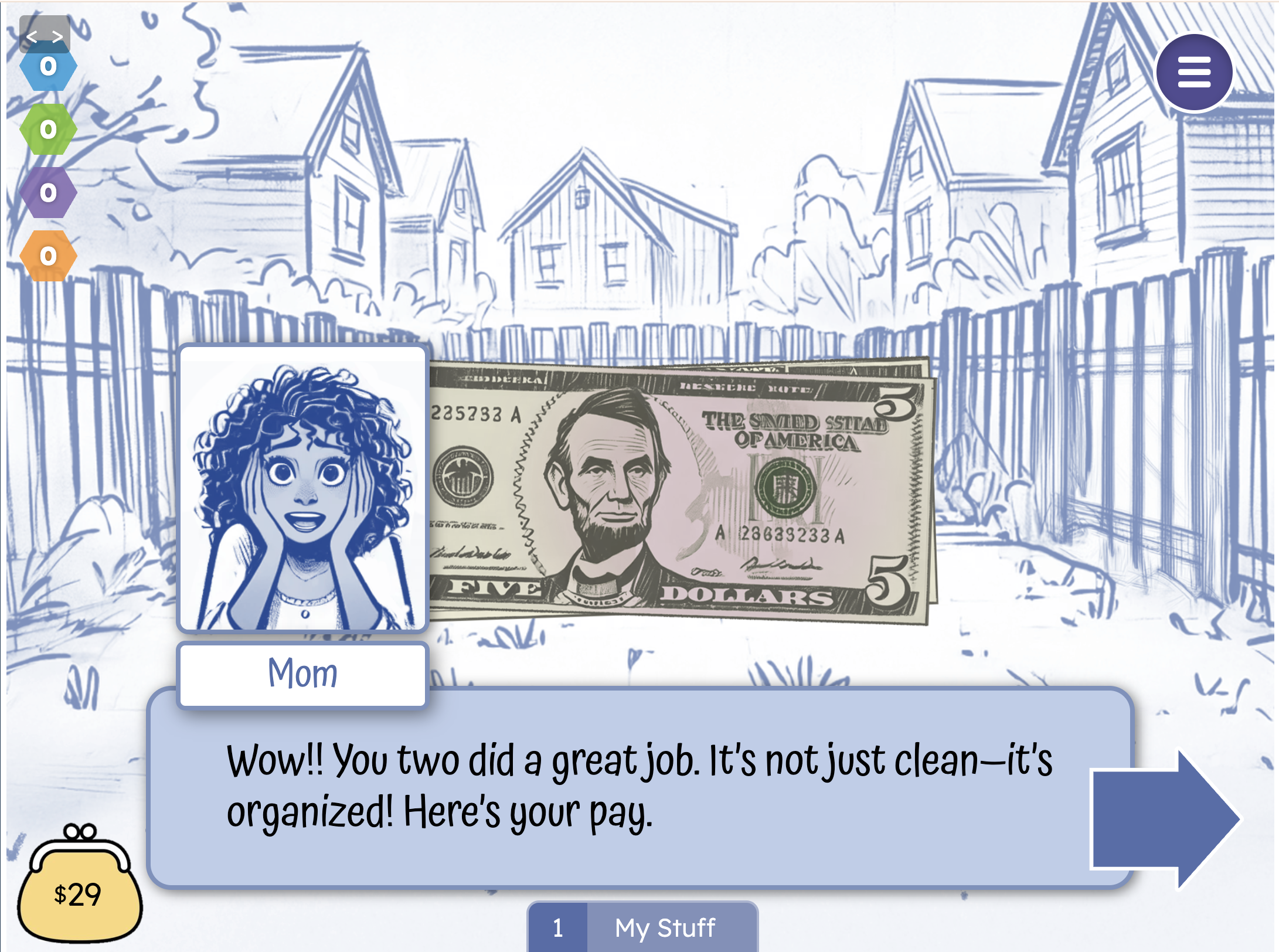

At the heart of the experience: Interactive Graphic Novel Adventures. Students take on roles, make decisions, and shape their stories as they:

Footsteps2Brilliance Financial Literacy is a cross-curricular program that helps students in grades 4–8 build career-ready skills while strengthening reading, writing, math, and critical thinking. They explore careers, make money choices, and apply what they learn in interactive graphic-novel story adventures. With built-in AI writing support and real-time reports, teachers get the tools they need to drive lifelong success.

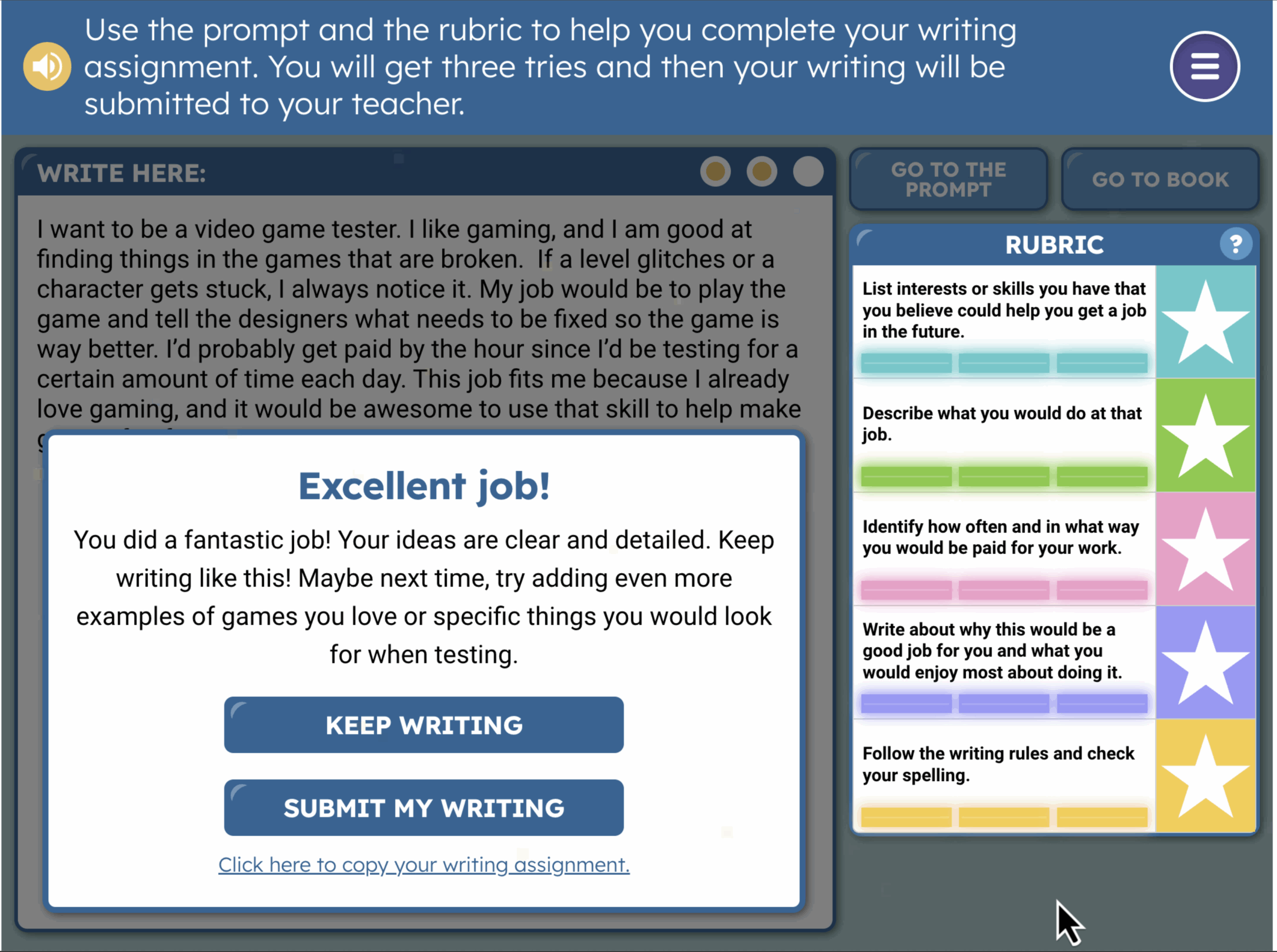

Students draft, revise, and improve in real time—earning stars, seeing growth, and building confidence. Teachers shift from grading to guiding, while students become independent, motivated writers.

We know initiatives fail when they burden staff. That’s why we made it turnkey:

With F2B Financial Literacy you’re not just checking a box. You’re expanding your district’s literacy ecosystem with a cross-curricular approach::

In pilot programs, students showed measurable growth in both financial knowledge and writing skills—while teachers reported higher engagement across the board.

F2B Financial Literacy is designed for students in grades 4–8, where financial literacy is both highly relevant and deeply engaging. By blending financial concepts with literacy and numeracy, the program makes academics meaningful while also teaching 21st-century skills like problem-solving, communication, and collaboration.

giving students extended time to practice financial decision-making in fun, interactive ways.

reinforcing comprehension, vocabulary, and writing skills through high-interest financial topics

connecting financial literacy to ELA standards for stronger engagement.

applying lessons to future careers, entrepreneurship, and real-world financial planning.

extending academic growth while keeping students motivated with interactive adventures.

F2B Financial Literacy is designed to tackle today’s biggest educational challenges:

“I am beyond excited about the AI generated grading rubric! Wow, the students are trying even more to improve their writing – amazing what the promise of a star will do for motivation!

I have been using the discussion questions and vocabulary with the class. They are engaged, for sure.”

-Cherie-Lynn Dardano

Teacher

“I have been assigning it during our reading intervention time for students to work through. I like that it has been supporting students with various reading skills. The writing AI feedback is great.

- Alyssa Ryan

Footsteps2Brilliance Financial Literacy for Career Readiness is a curriculum for grades 4–8 that teaches budgeting, saving, credit, banking, entrepreneurship, and career exploration skills aligned with financial literacy standards.

The program covers:

• Budgeting and saving

• Needs vs. wants

• Credit and debt

• Banking fundamentals

• Career exploration

• Postsecondary planning

• Entrepreneurship concepts

Yes. The curriculum aligns with state financial literacy standards and career readiness frameworks where required.

Yes. Districts implement the program within ELA, math, social studies, advisory periods, or as a standalone course.

Yes. The content is available in English and Spanish to support multilingual learners and family engagement.

Students explore career pathways, goal setting, income planning, and long-term financial decision-making aligned with workforce readiness skills.

In states where financial literacy is required for graduation, districts use this curriculum to meet instructional mandates.

Yes. Usage data and engagement metrics help administrators monitor implementation and document participation.

Yes. Districts receive onboarding, instructional guidance, and ongoing implementation support.

Yes. Districts commonly use Title I funds, literacy grants, bilingual education funding, and career readiness allocations.